Catherine Cashmore exclusive interview with Louis Christopher from SQM Research

13/04/2022

Rocketing inflation, rising rents, supply shortages leading to a “much deeper recession”? Exclusive interview with one of the country’s most respected analysts.

(Cross Posted from The Daily Reckoning Australia)

It’s all over the property news this week.

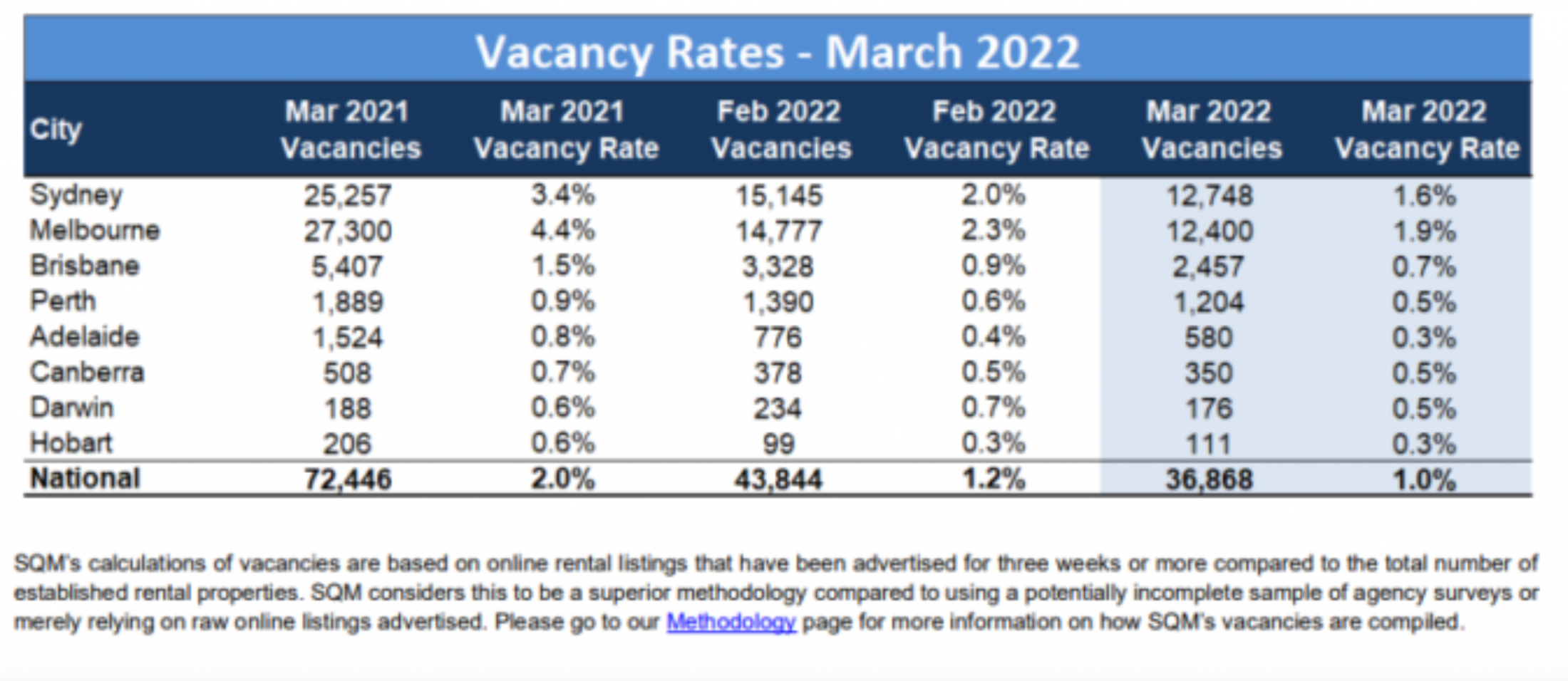

SQM Research released its national vacancy rate data. According to the statistics, rents are “exploding.”

There’s a record low number of rental properties available on the market – 1% nationally.

The lowest percentage in 16 years.

"The reality on the ground will be that many families, many young people will not be able to find the home that they actually require."

Said Louis Christopher - founder of SQM Research.

Across combined capital cities, asking rents are up 2.2%. That takes us to an 11.8% rise year-on-year.

Vacancy rates in Brisbane, Perth, Adelaide, Canberra, Darwin, and Hobart, all sit below 1%.

Take a look.

Source: SQM Research

If I’m not mistaken, 0.3% in Hobart, is the lowest on record for the city.

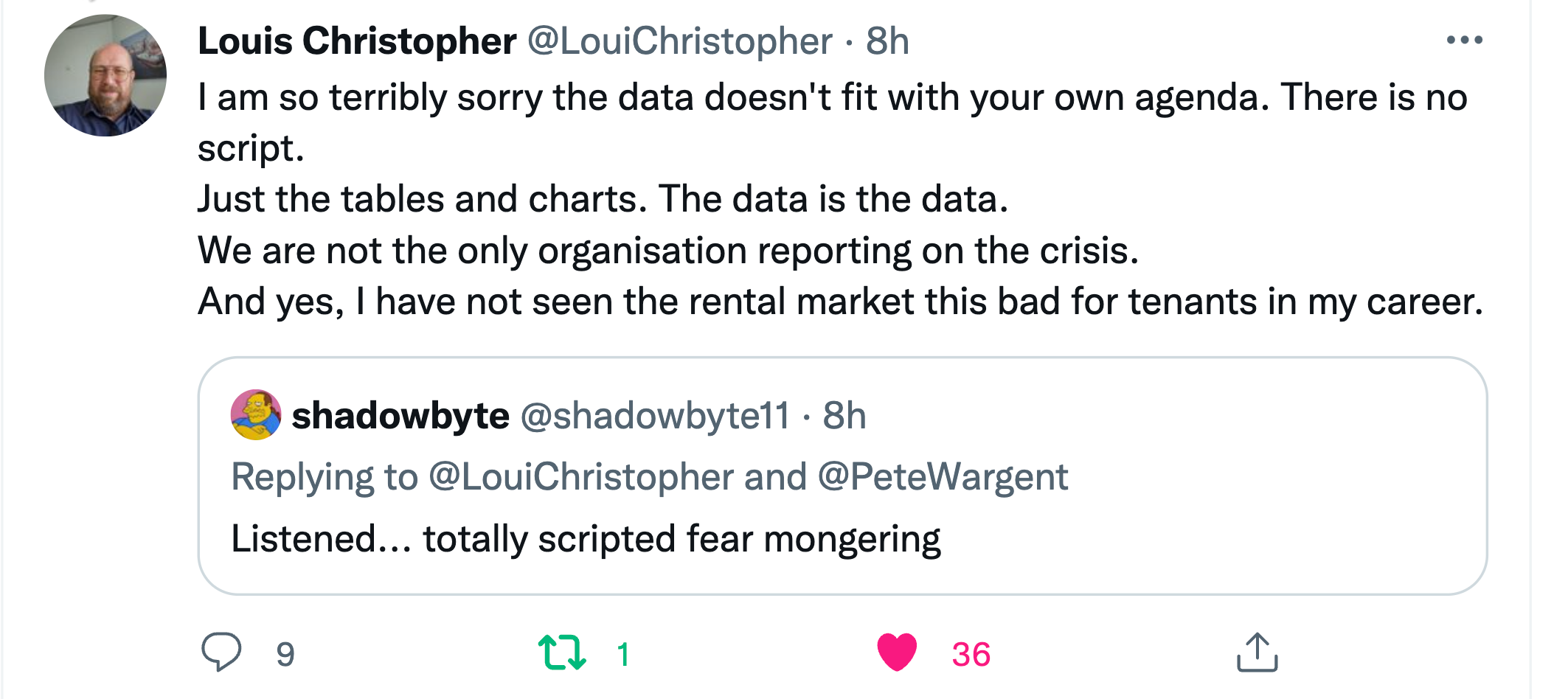

There’s nothing surprising about this, however, - despite some suggesting Louis is fear mongering.

Source: Twitter

The great exodus of COVID migrants taking advantage of work-from-home arrangements and fleeing inner city lockdowns, has produced an influx of population growth into regions that are ill prepared for it.

Shortages and rocketing increases in the price of building materials is further impacting oncoming supply.

Stories circulate of prospective tenants offering 6–12 months rental in advance to beat the competition.

Some offering more than $50 a week above the asking price!

Others are staying in caravan parks because their applications have been repeatedly turned down.

It’s worth mentioning here, that SQM Research is, in my opinion, the most reliable data agency for vacancy rates, auction statistics, stock on market, and much more.

I reference their data often when making forecasts on movements in the property market.

The founder, Louis Christopher is a long-time friend of mine and one of the country's most recognised and respected property analysts.

His reputation has been founded on consistently accurate forecasts that feature in his Housing Boom and Bust reports each year.

Furthermore, he has some strong opinions on what’s ahead. Particularly when it comes to inflation, and how you can buffer against it.

In his own words,

‘Inflation is going to accelerate from the current reported 3.5% and it's going to happen soon.

It's quite possible inflation may hit 10% or more before the year is out and highly probable we are going to at least 6%...

So, what should we do about this? Here is my gut view:

Hold tangible, real assets.

Yes, that is real estate. It's precious metals. It's REAL, tangible items of value that hold together during hard times. Don't be stupid about the buying price. And don't go overboard on taking on debt.

For at the end of this new energy and food crisis, it's very likely we will have a deeper recession.”

This chimes with a lot of what we talk about over at Cycles, Trends, & Forecasts.

Furthermore, we’ve given the timeline for exactly when we believe the “deeper recession” will occur. ((Find out why we’re so confident in this forecast by clicking here.)

I sat down with Louis this week to discuss all this and more.

It was an enlightening interview and one I was only going to share with my subscribers.

But I think Louis’ insights are so good, it’s something Daily Reckoning readers can gain much insight from.

All in all, it was a great honour and pleasure to host Louis. I hope you enjoy the discussion as much as I did.

Listen to the interview by clicking here.

Return